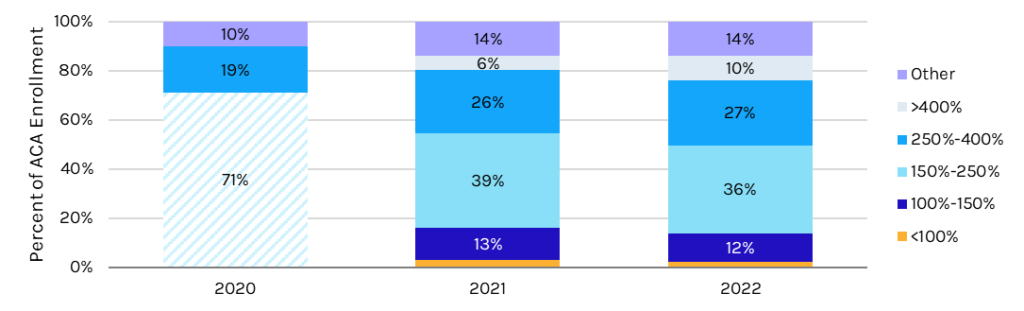

Capstone believes Congress will likely extend the enhanced American Rescue Plan Act’s (APRA) Affordable Care Act (ACA) subsidies (64% probability). Recent comments from Senator Joe Manchin (D-WV) signal that an extension of the subsidies will likely include means testing above current levels, where high-income enrollees (those who are 400% over the federal poverty line, or FPL) see lower subsidies. Given that most ACA enrollees are below 400% FPL, we do not expect the modifications to meaningfully reduce the upside of enhanced subsidies (see exhibit below).

Extension of the subsidies in any form will prevent a catastrophic disenrollment from the ACA in 2023, with the Centers for Medicare & Medicaid Services (CMS) predicting that without extension, as many as 3 million enrollees will become uninsured. The enhanced subsidies also will help mitigate enrollment losses when Medicaid redeterminations begin, which though currently tied to the public health emergency (PHE), could be decoupled as a payfor in the reconciliation package, making it easier for the administration to maintain the PHE.

In this note, Capstone analyst Grace Totman forecasts the extension of ACA subsidies, the FY2022 reconciliation bill, and the return of Medicaid redetermination, and predicts the impact these catalysts will have on insurers.

ACA Enrollment by Income as % of Federal Poverty Line

*Note: The ARPA passed in 2021, which made enrollees above 400% FPL eligible.

**Note: 2020 data did not break out by under 250% FPL. As such, the 71% enrollment in 2020 accounts for all individuals under 250% FPL. “Other” includes individuals whose income is unknown. It is presumed that most of the 4% growth in “other” from 2020 to 2021 is also above 400% FPL and newly eligible.

If you would like to read more, please contact sales@capstonedc.com.