Capstone believes a series of market design changes to be implemented by the Electric Reliability Council of Texas (ERCOT) will benefit short-duration battery storage, a relatively new, though rapidly growing, corner of the state’s power market.

Battery storage offers quick response capabilities, which is an advantage in the relatively unsaturated ancillary services market. These capabilities will grow in the next year with the likely implementation of the Fast Frequency Response (FFR) and ERCOT Contingency Reserve Service (ECRS), introduced as part of a market redesign to improve grid reliability after Winter Storm Uri caused mass outages in 2021.

Once market redesign concludes in 2023 and 2024, the Public Utility Commission of Texas (PUCT) and ERCOT will likely refocus efforts on operational changes, including a real-time co-optimization system. Starting in 2023, the growth in renewables will likely also lead to wider intraday price spreads depending on fluctuating cost of generation over time, offering storage an additional, robust stream of long-term revenue from energy arbitrage in the state.

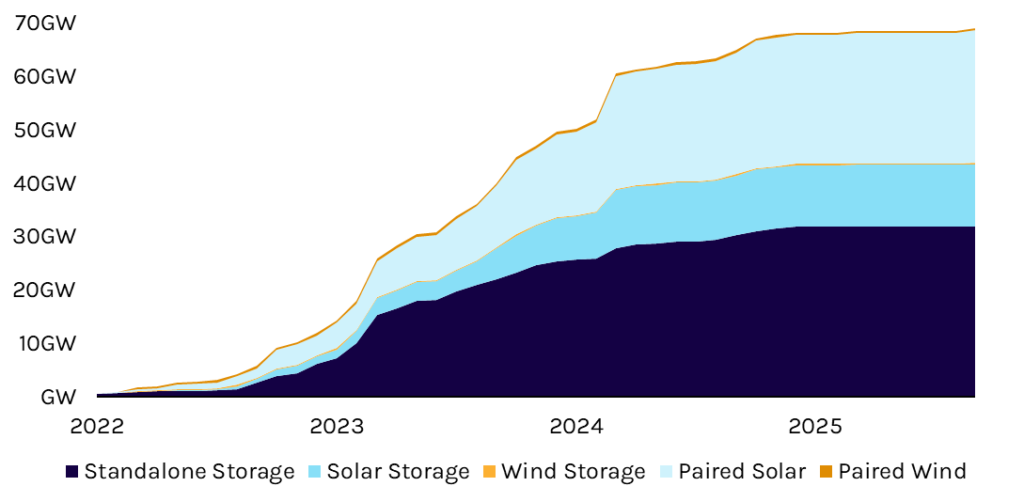

Planned ERCOT Standalone and Paired Storage, 2022-2025