February 18, 2023 – Capstone believes the European Central Bank (ECB) and Bank of England (BoE) will issue usable digital currencies in the next three to five years. We believe the emergence of central bank digital currencies (CBDCs), which 114 countries (including the US) are considering, will pose challenges for Visa Inc. (V) and Mastercard Inc. (MA) in the long term.

On 15th February, ECB President Christine Lagarde urged the European Parliament to start work swiftly on a legislative proposal for a digital euro that the European Commission intends to publish in a few months. The BoE and UK government issued a consultation on a digital pound on 7th February, indicating it will be needed later this decade.

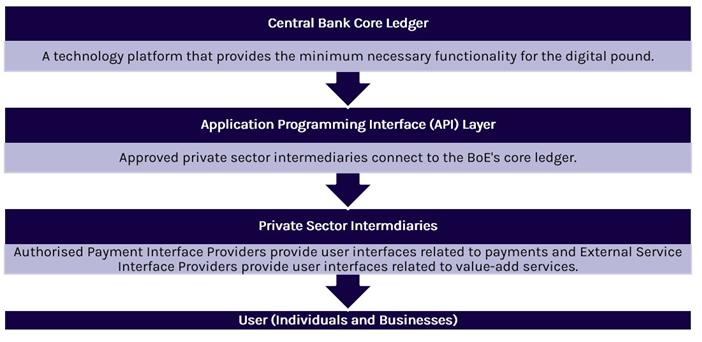

We believe the ECB and BoE are likely to adopt a ‘platform model’ where central banks provide ledger functionality and private firms offer customer-facing services, such as digital wallets. Depending on the extent of adoption, we believe the platform model poses a threat to the four-party card system that generates revenue for Visa and Mastercard, as well as acquirer banks.

Policymakers have strong incentives to facilitate adoption and are considering a range of options to achieve this, including giving CBDCs legal tender status and mandating merchant acceptance. If successful, it could disrupt the card market’s network effects and monopolistic tendencies. We believe merchants also have a cost incentive to accept CBDCs, as the fees for accepting card payments have risen in recent years.

Likely Structure of a UK CBDC