By: Dhanush Arun

April 28, 2021 — Is the European “clean transport” industry ready for take-off or grounded in reality? And what role will policymakers play in developing sustainable aviation fuels, the clean shipping supply chain, and the nascent electric vehicle market?

Last week Capstone hosted its inaugural virtual European Clean Transport Summit, during which we held a series of panel discussions, exclusively for clients, with European CEOs, distinguished policymakers, and industry executives covering the decarbonization of aviation, shipping, and road transport. Below are some of our thoughts.

Growing Policy Backdrop for Sustainable Aviation Fuels

Despite the obvious challenges of the pandemic on global aviation, the sector’s commitment to decarbonisation has not waned, and the Sustainable Aviation Fuel (SAF) market will likely benefit in the near to midterm from coordinated policy support. Globally, compliance with the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which requires airlines to purchase carbon offsets or to use alternative fuels, will likely promote SAF consumption. In Europe, both at the EU-level and in the UK, SAF blending obligations are likely to be implemented on either fuel suppliers or airlines (or a combination of both).

The tightening of the feedstock market—an essential component of renewable fuel—was a topic of more exuberant debate amongst our panellists, with Neste CEO, Peter Vanacker, pouring cold water on the concern that supply is limited, suggesting that there is ample feedstock supply to support a robust SAF market. However, Head of Low Carbon Fuels at the UK DfT, Rachel Solomon Williams, conceded that while there may be enough feedstocks, affordability is still an issue, and trade-offs with other industries which compete for the same supply, like road transport and shipping, must be factored into policymaking.

Capstone believes there is an 80% probability that the European Commission introduces a SAF blending mandate in 2021 and a 75% probability that the UK will agree to introduce a SAF blending mandate by the end of 2022. We believe these measures will positively impact the stock performance of Neste Oyj (NESTE on the Helsinki exchange).

Sustainable Shipping: IMO 2020 a Litmus Test for What Comes Next

IMO’s successful implementation of the sulphur emissions cap on January 1, 2020, which limits the sulphur content in marine fuels, serves as a litmus test for the future implementation of more stringent emission regulations in the global shipping sector. Our panellists underlined the importance of international policy measures in the global shipping sector and highlighted the effectiveness of IMO 2020 in applying the polluter pays principle in shipping. The panellists also encouraged more alignment amongst policymakers on what fuel to use to best enable the sector’s decarbonization with hydrogen, ammonia, and LNG (as a possible transitionary fuel) all being considered.

Capstone believes the trend toward stricter emission regulations for the shipping industry will continue. We believe mounting pressure from industry and environmental groups is likely to increase emission reduction regulations from IMO, further boosting demand for alternative fuels such as hydrogen, ammonia, and LNG. A revised version of IMO’s 2018 GHG reduction strategy is expected before 2023. The revised strategy is likely to be more granular and could potentially include changes such as raising the carbon intensity reduction target to 50% by 2030 compared to 2008 levels.

Electric Vehicle Policy May Backfire, Despite Ambitions

The European EV market has seen substantial growth, increasing its sales of electric and plug-in hybrid electric vehicles by 137% in 2020. Europe is now the largest market for electric vehicles globally, overtaking China in EV sales for the first time in five years, with approximately 1.4 million sold in 2020.

Asia still dominates the EV battery market, with China, Korea, and Japan accounting for over 90% of global lithium-ion battery manufacturing. However, Europe is planning to ramp up production over the next decade. Europe will have a 16% share of the 2550 GWh global battery market by 2029, compared to its current share of less than 6% of today’s 450 GWh, according to Batteries Europe, the technology and innovation platform of the EU’s European Battery Alliance.

Policy and regulation have no small role to play in these expansion plans. In December 2020, the European Commission published its proposal for a new Battery Regulation to reform the use and supply chain of batteries throughout Europe. The EU hopes the new proposal will support green, local battery producers, giving them a competitive advantage over other players with a higher CO2 footprint for battery manufacturing. However, the regulation is at risk of backfiring, hitting a nascent European battery market with stringent regulations that larger, more established international battery players will be able to meet faster and with more economy. CEO of FREYR Battery, Tom Einar Jensen, welcomed the higher standards, however, stating that it is in line with FREYR’s ambition to produce batteries with the world’s lowest carbon footprint.

Capstone estimates the European Commission’s proposal would cost an additional €500 million per year for the €3 billion-4 billion European industry. This estimate excludes investment costs needed for the recycling efficiency and material recovery requirements, meaning total costs would likely be even higher.

These are just a smattering of the growing policy dynamics that will help determine if European ambitions can be achieved and who the winners and losers will be. Our research team continues to dig into proposals and plans, and our outreach team will continue to set up high-level meetings to client knowledge and analysis of the matters.

European policy will continue to be a key driver in the success and failure of myriad established companies, startups, and industry players fighting to reinvent themselves. Investors should pay attention. There will be false starts, and there will be substance. We look forward to helping our clients figure out which is which.

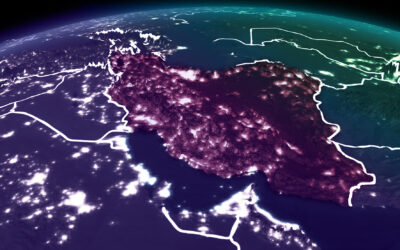

After Iran’s Strike: What Happens Next

April 15, 2024 By Daniel Silverberg and Elena McGovern, co-heads of Capstone’s National Security Practice As crazy as it seems, a favorable scenario between Iran and Israel appears to be playing out amidst red-hot tensions in the Middle East. Iran was expected to...