June 9, 2021 — In this weekly bulletin, the Capstone Financial Services team shares insights on key policy priorities for the Department of Education (ED) in its administrative capacity. On May 24, ED solicited stakeholder input on various potential regulatory changes. The department has prioritized tackling issues of student loan payments and student loan forgiveness before the gainful employment rule and the bundled services exemption. In this bulletin, we address those priorities in order of impact and how they will affect companies in the higher education space in the coming years. For the purposes of this bulletin, we only consider policy changes ED can realize unilaterally through the rulemaking process or through changes to previous guidance.

Gainful Employment

Capstone believes the return of the gainful employment rule is both a longer-term priority for the Biden administration and a materially negative development for most for-profit colleges. Democrats and student advocates were highly critical of the Trump administration’s decision to rescind the rule, which applied earnings-to-debt requirements to for-profit colleges in order to continue receiving federal funding. While the details of any future rule are unclear, it would likely resemble the old rule which effectively calculates the ratio of the earnings of program graduates to their average debt payments. As such, programs that focus on high demand fields (such as nursing) would likely be better positioned than those that resemble traditional liberal arts colleges.

While Education Secretary Miguel Cardona has spoken about gainful employment less frequently than other higher education issues, the department did solicit stakeholder comments on the topic regarding several areas of potential regulation ahead of hearings scheduled for late June. However, revamping the gainful employment rule is likely to take years given the federal rulemaking process and the complicated and contentious nature of the issue. Additionally, given the multi-year data collection component of the rule, it would likely be years before its enforcement would lead to programs losing access to Title IV funding.

Bundled Service Exemption

In 2011, the Education Department published a Dear Colleague Letter (DCL) providing guidance allowing an exemption for incentive compensation which is otherwise prohibited in the Higher Education Act of 1965 (HEA). The allowance, known as “the bundled services exemption,” the exemption permits a college or university to make incentive payments for recruiting if the third-party contractor provides services in addition to recruiting. This exemption is widely used by online program managers.

Democrats have grown increasingly concerned by online program managers and the DCL in recent years. Because this exemption exists only as guidance, we believe it is likely to be rescinded during the Biden Administration’s first term. However, the DCL is unlikely to be as high a priority as student debt relief or regulation of for-profit colleges and, as such, is likely to be addressed later in the term when higher-priority issues have been addressed. There don’t appear to be any public statements on OPMs attributed to Cardona or to James Kvaal, Biden’s nominee for Under Secretary of Education.

The DCL wasn’t mentioned when the department solicited stakeholder comment earlier this year. However, the OPM model is likely to be raised in the context of the gainful employment rule (which did not apply to not-for-profits that partnered with OPMs), something critics view as a flaw. In any case, a public hearing in late June will likely make clear whether the OPM model is of concern to ED.

Rescinding the bundled services exemption would be a significant headwind for OPMs (such as Grand Canyon Education [LOPE] and 2U [TWOU]) and Coursera (COUR), which also relies on the exemption.

Student Loan Payments

Capstone believes that restarting the student loan repayment system, which has been paused since March 2020, will be ED’s top priority. The current repayment suspension is set to expire at the end of September.

Restarting student loan repayments will be logistically challenging, occupying a significant amount of ED’s attention. The department needs to ensure students know they should resume making payments in October and that servicers are prepared and communicating effectively with borrowers. Additionally, ED will likely devote resources to helping students who cannot meet their obligations once payments come due again. Restarting student payments will have minor, favorable implications for student loan servicers such as Navient (NAVI). While ED has continued paying servicers for the students they have been allotted, the per-student revenue has been lower due to the structure of ED contracts. Once payments resume, per student revenue will return to pre-pandemic levels.

While an extension of the repayment suspension is possible, we assess the probability of this outcome at 40%.

Student Loan Forgiveness

We view widespread student loan forgiveness as unlikely (largely due to questionable legal grounds), although there are several steps ED could take to forgive some portion of outstanding federal student loan debt through authority it already has under the Higher Education Act. Because of this, and the political importance of student loan debt, we believe ED will devote much of its attention to crafting rules and regulations that will give it the unilateral ability to waive more debt. At a May 7 roundtable, ED Secretary Miguel Cardona said, “we’re going to be focusing on [student loan forgiveness]. We have tools in our toolbox at the Department of Education that I don’t think are working, and we need to fix them. We need to work hard to make sure that the intention of those tools—in this case, the Public Service Loan Forgiveness program—is working in the way it’s supposed to.”

Specifically, we anticipate that ED will amend the borrower defense rule (facilitating debt cancellation for students who allege they were defrauded by their college/university) and rules allowing for the department to cancel debts students who are disabled or have taken jobs with the government (the Public Service Loan Forgiveness program). We expect that ED will lower the standard of evidence needed to have student loans cancelled or the principal reduced (in the case of the borrower defense rule) or simplify the process and shorten the timeline (in the case of government employees).

ED’s loosening of the borrower defense rule would be a negative for for-profit colleges because they are held partially liable for waived debt. Other potential amendments would be unlikely to have a significant impact on companies in the sector.

For more information, contact sales@capstonedc.com.

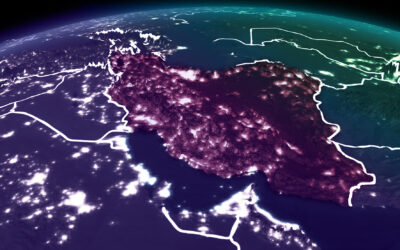

After Iran’s Strike: What Happens Next

April 15, 2024 By Daniel Silverberg and Elena McGovern, co-heads of Capstone’s National Security Practice As crazy as it seems, a favorable scenario between Iran and Israel appears to be playing out amidst red-hot tensions in the Middle East. Iran was expected to...