Healthcare

We predict future policy changes, quantify their impact on your business, and develop strategies to unlock hidden revenue opportunities.

We Predict Policy, Quantify Impact, and Create Strategy

Corporations and investors lean on Capstone’s expertise in healthcare policy to gain valuable insights on regulatory risks and global opportunities. Our process is designed to uncover innovative policy-driven ideas, advising private equity firms, corporations, and investors on the impact of regulation on potential and existing investments.

We leverage our ability to wade through public records of existing and proposed regulation, legislation, and other policy efforts. We combine that with our relationships with major industry associations, as well as senior policymakers and influential experts, to add value and identify opportunities for investment growth.

INTRO

HEALTHCARE COVERAGE

HEALTHCARE CAPABILITIES

HEALTHCARE EDGE

KEY THEMES

SELECTED ISSUES

CASE STUDIES

INSIGHTS

IN THE NEWS

GET IN TOUCH

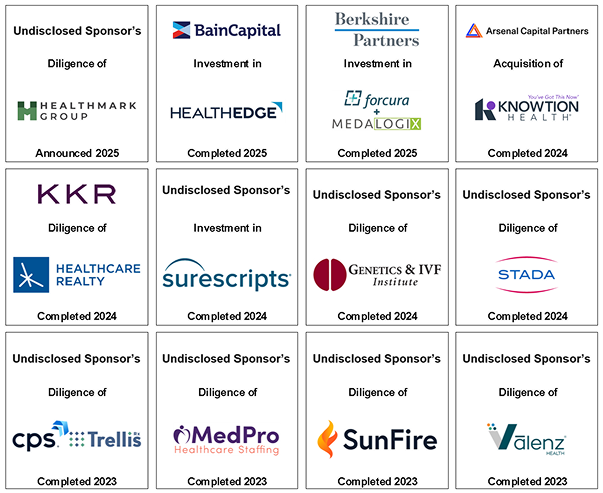

Select Healthcare Transitions

Capstone has been a trusted adviser on many public transactions. Below is a selection of recent transactions.

Healthcare Coverage

24 FTE's

18 research analysts, 3 business development professionals, and 3 support staff

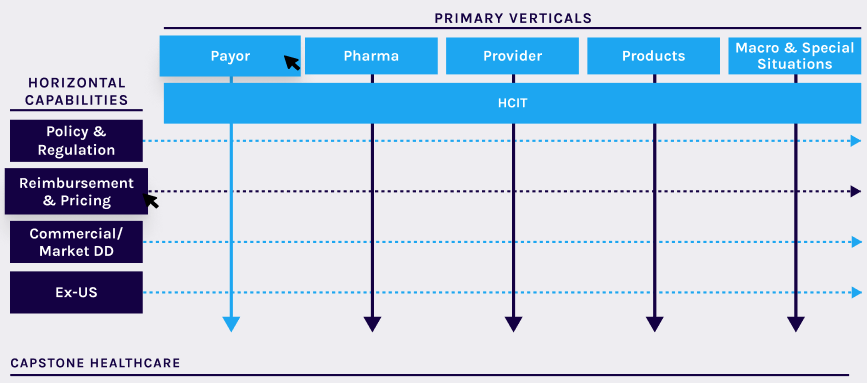

6 Verticals

Broadly defined verticals enable collaborative coverage of the entire US healthcare sector

4 Key Capabilities

Analysis of policy & regulation, reimbursement & pricing, commercial due diligence, ex-US analysis

90 Engagements

Comprehensive coverage and an obsessive focus on client service led to ~90 PE engagements in LTM

Healthcare Coverage

- Federal and State Policy Analysis

- Reimbursement and Pricing

- Market Sizing and Share

- HCIT

- Competitive Positioning and VoC

Market Sizing and Share

Leverage open-source, proprietary, and vended datasets to build granular, high-fidelity bottom-up market sizing and market share model. Supplement bottom-up build with expert interviews and surveys to develop top-down validation and perform sensitivity analysis.

SOURCES OF INSIGHT / DATA

Leverage open-source, proprietary, and vended datasets to build granular, high-fidelity bottom-up market sizing and market share model. Supplement bottom-up build with expert interviews and surveys to develop top-down validation and perform sensitivity analysis.

Capstone’s Healthcare Edge: Real-time insights, investment-driven analysis, and deal team partnership yields tailored, concise, and actionable products

WHAT SEPARATES CAPSTONE HEALTHCARE FROM THE COMPETITION

Proprietary Network

Capstone leverages a proprietary and purpose-built network of experts and other professionals involved in policy formation, influence, and analysis, including current and former policymakers, trade associations, lobbyists, government affairs staff, think tanks, and other policy thought leaders.

Real-Time 360 Policy/Regulatory Channel Checks

Instead of relying exclusively on former policymakers, institutional knowledge, and prior engagement work, Capstone provides real-time insights and channel checks. Capstone is non-partisan and agnostic to policy outcomes (i.e., we do not advocate/lobby), which keeps lines of communication open and honest.

Diverse Client Set

Capstone works across both the capital structure and the investment lifecycle. Our diversified client set includes private equity, growth equity, and venture capital firms; private credit and direct lending firms; long-only, long/short, multi-manager, and distressed/opportunistic credit hedge funds; and portfolio companies and corporates.

Investment-Driven Approach and Analysis

This approach provides Capstone with a unique perspective on each transaction and business and promotes more thoughtful analysis. Capstone frames all policy and regulatory risks through a financial and operational lens, making our products better-suited for discerning how policy and regulatory changes impact a company’s business model and economics.

Obsessive Focus on Quality Service and Quality Product

One dedicated team will work with you from scope writing to final deliverable to avoid misplaced incentives or less actionable products. Our involvement from start to finish ensures that no questions are left unanswered and we can direct resources toward policy/commercial considerations that may be less obvious but more impactful.

Partners in the Process

Every deliverable is tailor-made, based on a specific company’s operating model and strategy—not just major thoughts on the state of a given sector or “book report.” We tailor our work, communication, and service to meet the unique approaches and cultures of the deal teams, ICs, and sponsors we work with. The final deliverable synthesizes our outreach, research, and experience into an IC-ready deck.

Access to Capstone Events

One dedicated team will work with you from scope writing to final deliverable to avoid misplaced incentives or less actionable products. Our involvement from start to finish ensures that no questions are left unanswered and we can direct resources toward policy/commercial considerations that may be less obvious but more impactful.

Interoperability on the Horizon

Capstone believes healthcare is in the early stages of digitization with a most healthcare data still fragmented, coming from countless (and growing) sources, stored in numerous formats, and exchanged in multiple ways, creating complexity and opportunity. While the increasing velocity of federal regulation and frameworks is accelerating innovation, we believe complete interoperability is still distant, leaving opportunity for existing vendors. In general, we believe increased data liquidity creates near-term opportunity for analytics-based companies while posing risk to “pipes” companies.

Key Policy and Investment Themes

- Medicaid Despite OBBBA

- New ‘Doc Fix’ Era

- Interoperability on the Horizon

- CMS Innovation Center Power

- Ambulatory Site of Care Trends

Selected Issues

Payor

Capstone believes a FHIR-API driven exchange ecosystem supports eased access to healthcare data, benefiting vendors that support payors and providers with data-driven insights.

Key Takeaways:

- Overview: HHS is moving toward API-driven data exchange due to the 21st Century Cures Act. CMS-regulated payors must implement FHIR-based APIs to enable disparate systems to communicate, allowing for real-time data exchange and increased patient access. Certified EHRs may be required to “connect” to payor-required APIs, creating direct connections that SaaS vendors have historically leveraged as value-added.

- Context: Since 2021, patients can download their payor-maintained health data into third-party applications. Beginning in 2027, payors will be required to share data with providers that are INN and have a treatment relationship with the patient, and other payors. Through a Prior Authorization API, the agency hopes to solve the problem of delayed care due to data exchange inefficiencies. This API-based ecosystem increases healthcare data liquidity, creating an environment where data is more available.

- Outlook: The 21st Century Cures Act further established a structured data set called USCDI. While USCDI is limited, the data set is constantly expanding. Since structured data is more valuable, and FHIR APIs enable real-time exchange, Capstone believes the data exchange ecosystem provides opportunities for patient-facing apps, analytics vendors that rely on data access, and data monetization.

Provider

Capstone believes a FHIR-API driven exchange ecosystem supports eased access to healthcare data, benefiting vendors that support payors and providers with data-driven insights.

Key Takeaways:

- Overview: HHS is moving toward API-driven data exchange due to the 21st Century Cures Act. CMS-regulated payors must implement FHIR-based APIs to enable disparate systems to communicate, allowing for real-time data exchange and increased patient access. Certified EHRs may be required to “connect” to payor-required APIs, creating direct connections that SaaS vendors have historically leveraged as value-added.

- Context: Since 2021, patients can download their payor-maintained health data into third-party applications. Beginning in 2027, payors will be required to share data with providers that are INN and have a treatment relationship with the patient, and other payors. Through a Prior Authorization API, the agency hopes to solve the problem of delayed care due to data exchange inefficiencies. This API-based ecosystem increases healthcare data liquidity, creating an environment where data is more available.

- Outlook: The 21st Century Cures Act further established a structured data set called USCDI. While USCDI is limited, the data set is constantly expanding. Since structured data is more valuable, and FHIR APIs enable real-time exchange, Capstone believes the data exchange ecosystem provides opportunities for patient-facing apps, analytics vendors that rely on data access, and data monetization.

Pharma

Capstone believes a FHIR-API driven exchange ecosystem supports eased access to healthcare data, benefiting vendors that support payors and providers with data-driven insights.

Key Takeaways:

- Overview: HHS is moving toward API-driven data exchange due to the 21st Century Cures Act. CMS-regulated payors must implement FHIR-based APIs to enable disparate systems to communicate, allowing for real-time data exchange and increased patient access. Certified EHRs may be required to “connect” to payor-required APIs, creating direct connections that SaaS vendors have historically leveraged as value-added.

- Context: Since 2021, patients can download their payor-maintained health data into third-party applications. Beginning in 2027, payors will be required to share data with providers that are INN and have a treatment relationship with the patient, and other payors. Through a Prior Authorization API, the agency hopes to solve the problem of delayed care due to data exchange inefficiencies. This API-based ecosystem increases healthcare data liquidity, creating an environment where data is more available.

- Outlook: The 21st Century Cures Act further established a structured data set called USCDI. While USCDI is limited, the data set is constantly expanding. Since structured data is more valuable, and FHIR APIs enable real-time exchange, Capstone believes the data exchange ecosystem provides opportunities for patient-facing apps, analytics vendors that rely on data access, and data monetization.

HCIT

Capstone believes a FHIR-API driven exchange ecosystem supports eased access to healthcare data, benefiting vendors that support payors and providers with data-driven insights.

Key Takeaways:

- Overview: HHS is moving toward API-driven data exchange due to the 21st Century Cures Act. CMS-regulated payors must implement FHIR-based APIs to enable disparate systems to communicate, allowing for real-time data exchange and increased patient access. Certified EHRs may be required to “connect” to payor-required APIs, creating direct connections that SaaS vendors have historically leveraged as value-added.

- Context: Since 2021, patients can download their payor-maintained health data into third-party applications. Beginning in 2027, payors will be required to share data with providers that are INN and have a treatment relationship with the patient, and other payors. Through a Prior Authorization API, the agency hopes to solve the problem of delayed care due to data exchange inefficiencies. This API-based ecosystem increases healthcare data liquidity, creating an environment where data is more available.

- Outlook: The 21st Century Cures Act further established a structured data set called USCDI. While USCDI is limited, the data set is constantly expanding. Since structured data is more valuable, and FHIR APIs enable real-time exchange, Capstone believes the data exchange ecosystem provides opportunities for patient-facing apps, analytics vendors that rely on data access, and data monetization.

Products

Capstone believes a FHIR-API driven exchange ecosystem supports eased access to healthcare data, benefiting vendors that support payors and providers with data-driven insights.

Key Takeaways:

- Overview: HHS is moving toward API-driven data exchange due to the 21st Century Cures Act. CMS-regulated payors must implement FHIR-based APIs to enable disparate systems to communicate, allowing for real-time data exchange and increased patient access. Certified EHRs may be required to “connect” to payor-required APIs, creating direct connections that SaaS vendors have historically leveraged as value-added.

- Context: Since 2021, patients can download their payor-maintained health data into third-party applications. Beginning in 2027, payors will be required to share data with providers that are INN and have a treatment relationship with the patient, and other payors. Through a Prior Authorization API, the agency hopes to solve the problem of delayed care due to data exchange inefficiencies. This API-based ecosystem increases healthcare data liquidity, creating an environment where data is more available.

- Outlook: The 21st Century Cures Act further established a structured data set called USCDI. While USCDI is limited, the data set is constantly expanding. Since structured data is more valuable, and FHIR APIs enable real-time exchange, Capstone believes the data exchange ecosystem provides opportunities for patient-facing apps, analytics vendors that rely on data access, and data monetization.

Case Studies

Capstone has a proven track record of providing in-depth analysis across a wide range of policy and regulatory issues. Our case studies demonstrate our ability to help clients navigate complex policy challenges and develop targeted revenue-driving strategies.

Our Latest Healthcare Insights

Discover the latest insights from Capstone analysts offering perspectives on policy and regulatory issues that we believe investors and businesses underappreciate. Our thought-provoking analyses are designed to empower leaders to navigate complex challenges and drive successful outcomes.

Europe’s Battery Storage Edge

Capstone believes investors will prioritise the contracted and hybrid battery energy storage markets of the UK, Italy, and Poland, delivering our estimated 12%-17% unlevered returns, backed by policy support and leverage. The merchant-driven markets of France,...

Data Centers’ Collision Course with the Ballot Box

Capstone leadership attended the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC), a gathering of over 2,200 companies across the energy value chain, the first week of November. The atmosphere was...

Texas Grid: Renewables Avoid Worst Case as Regulator Considers Battery Storage

Capstone believes that compliance with firming requirements will eventually be more manageable for the renewable energy industry after the Public Utility Commission of Texas (PUCT) amends its original proposal and makes battery storage an eligible resource. ERCOT is...